Your search results

PROPERTY TIMES BUCHAREST OFFICE H1 2015

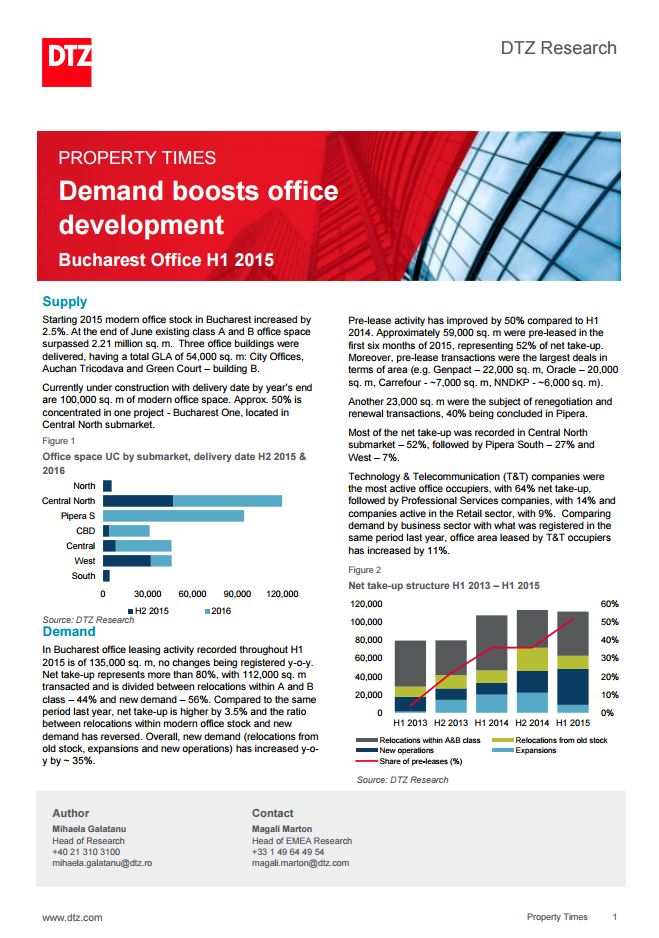

Starting 2015 modern office stock in Bucharest increased by 2.5%. At the end of June existing class A and B office space surpassed 2.21 million sq. m. Three office buildings were delivered, having a total GLA of 54,000 sq. m: City Offices, Auchan Tricodava and Green Court – building B. Currently under construction with delivery date by year’s end are 100,000 sq. m of ...

DTZ – CEE OFFICE MARKET 2014

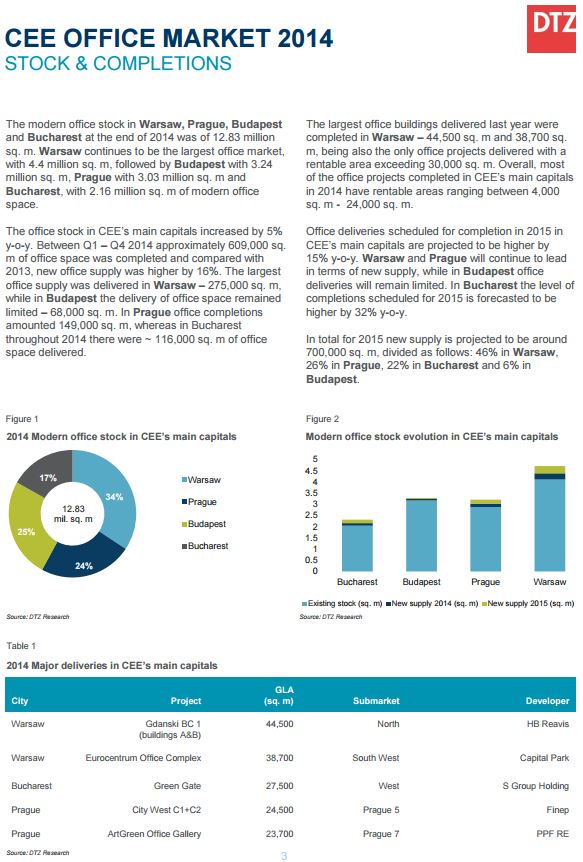

The modern office stock in Warsaw, Prague, Budapest and Bucharest at the end of 2014 was of 12.83 million sq. m. Warsaw continues to be the largest office market, with 4.4 million sq. m, followed by Budapest with 3.24 million sq. m, Prague with 3.03 million sq. m and Bucharest, with 2.16 million sq. m of modern office space. The office stock in CEE’s ...

PROPERTY TIMES BUCHAREST OFFICE 2014

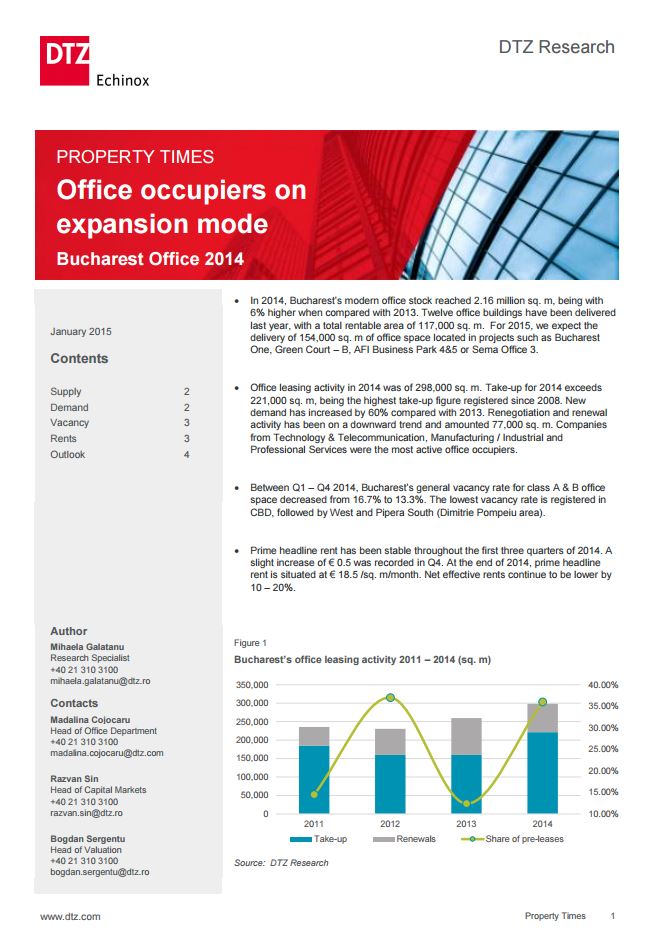

In 2014, Bucharest’s modern office stock reached 2.16 million sq. m, being with 6% higher when compared with 2013. Twelve office buildings have been delivered last year, with a total rentable area of 117,000 sq. m. For 2015, we expect the delivery of 154,000 sq. m of office space located in projects such as Bucharest One, Green Court – B, AFI Business Park 4&5 ...

BUCHAREST OFFICE MARKET – SNAPSHOT SUPPLY & DEMAND Q3 2014

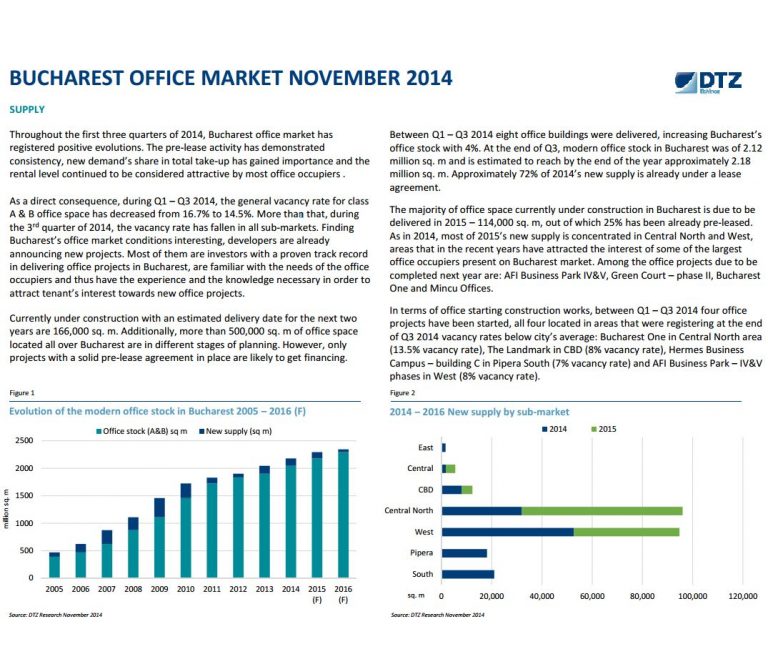

Throughout the first three quarters of 2014, Bucharest office market has registered positive evolutions. The pre-lease activity has demonstrated consistency, new demand’s share in total take-up has gained importance and the rental level continued to be considered attractive by most office occupiers . As a direct consequence, during Q1 – Q3 2014, the general vacancy rate for class A & B office space has ...

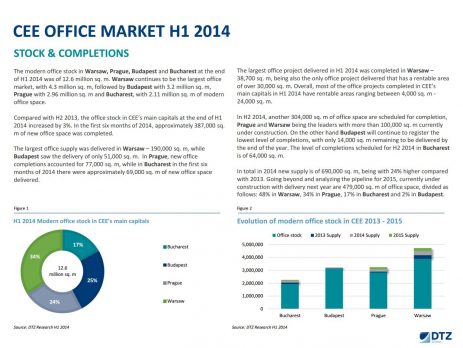

CEE OFFICE MARKET – H1 2014

The modern office stock in Warsaw, Prague, Budapest and Bucharest at the end of H1 2014 was of 12.6 million sq. m. Warsaw continues to be the largest office market, with 4.3 million sq. m, followed by Budapest with 3.2 million sq. m, Prague with 2.96 million sq. m and Bucharest, with 2.11 million sq. m of modern office space. Compared with H2 2013, ...

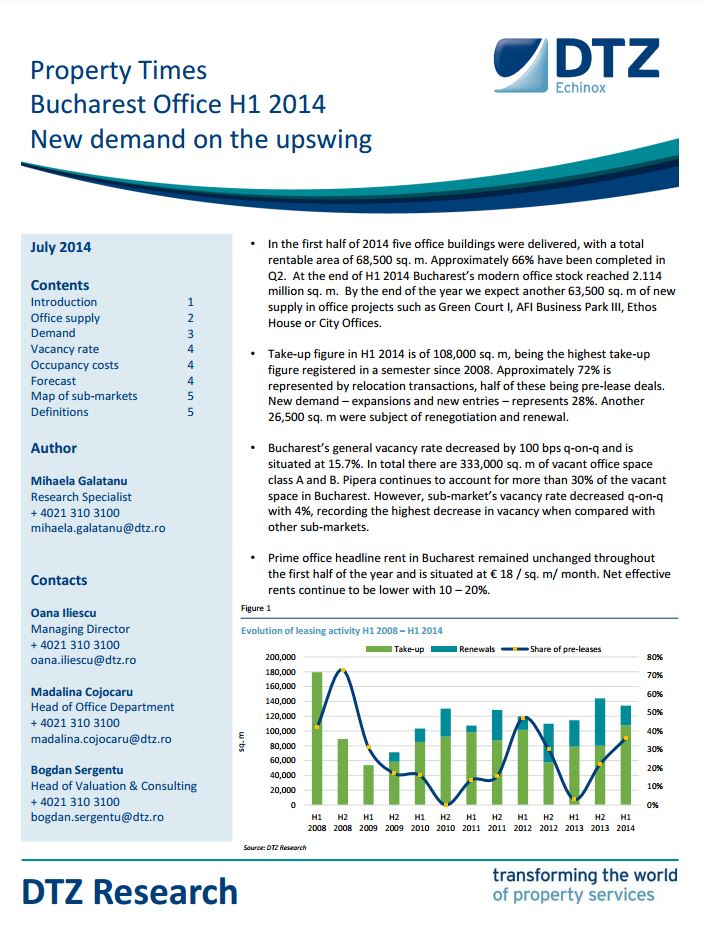

PROPERTY TIMES BUCHAREST H1 2014 OFFICE MARKET

In the first half of 2014 five office buildings were delivered, with a total rentable area of 68,500 sq. m. Approximately 66% have been completed in Q2. At the end of H1 2014 Bucharest’s modern office stock reached 2.114 million sq. m. By the end of the year we expect another 63,500 sq. m of new supply in office projects such as Green Court ...

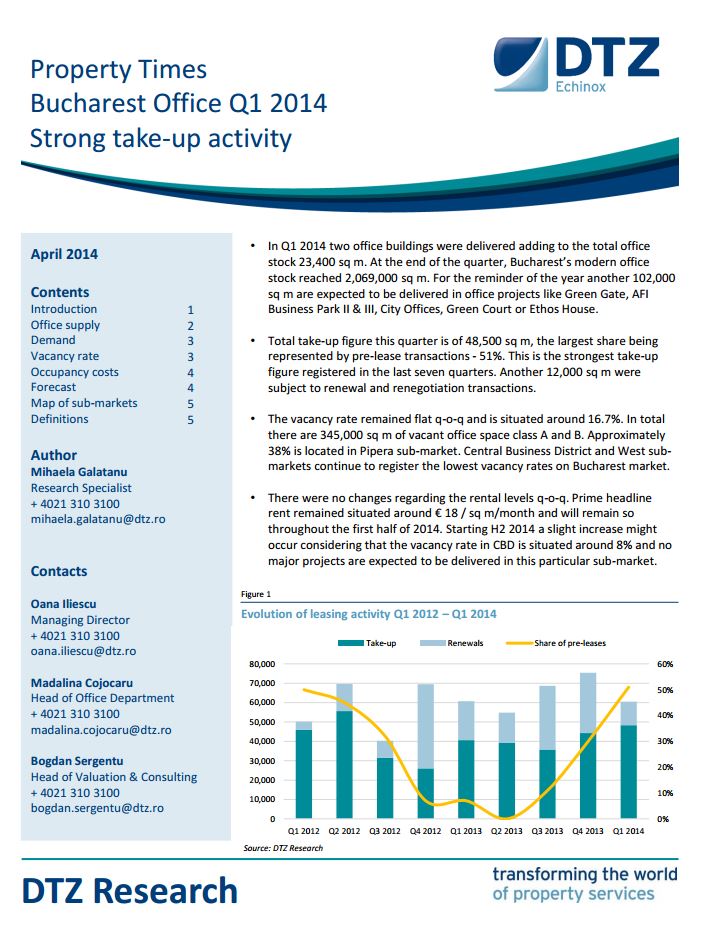

DTZ PROPERTY TIMES BUCHAREST Q1 2014 OFFICE MARKET

In Q1 2014 two office buildings were delivered adding to the total office stock 23,400 sq m. At the end of the quarter, Bucharest’s modern office stock reached 2,069,000 sq m. For the reminder of the year another 102,000 sq m are expected to be delivered in office projects like Green Gate, AFI Business Park II & III, City Offices, Green Court or Ethos ...

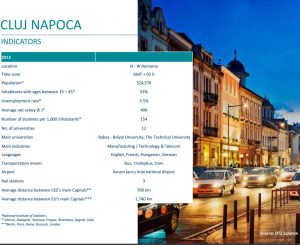

REGIONAL CITIES 2014 – OFFICE MARKET OVERVIEW

– 2nd Largest city in Romania after Bucharest – University center in Romania after Buchares – Largest Airport in Romania in terms of traffic* – Major companies: MOL, Emerson, Ursus, Genpact, De’Longhi, Bosh – 2015 European Capital of Youth – Competes for the title of European Capital of Culture in 2021 *Over 1,000,000 passengers in 2013

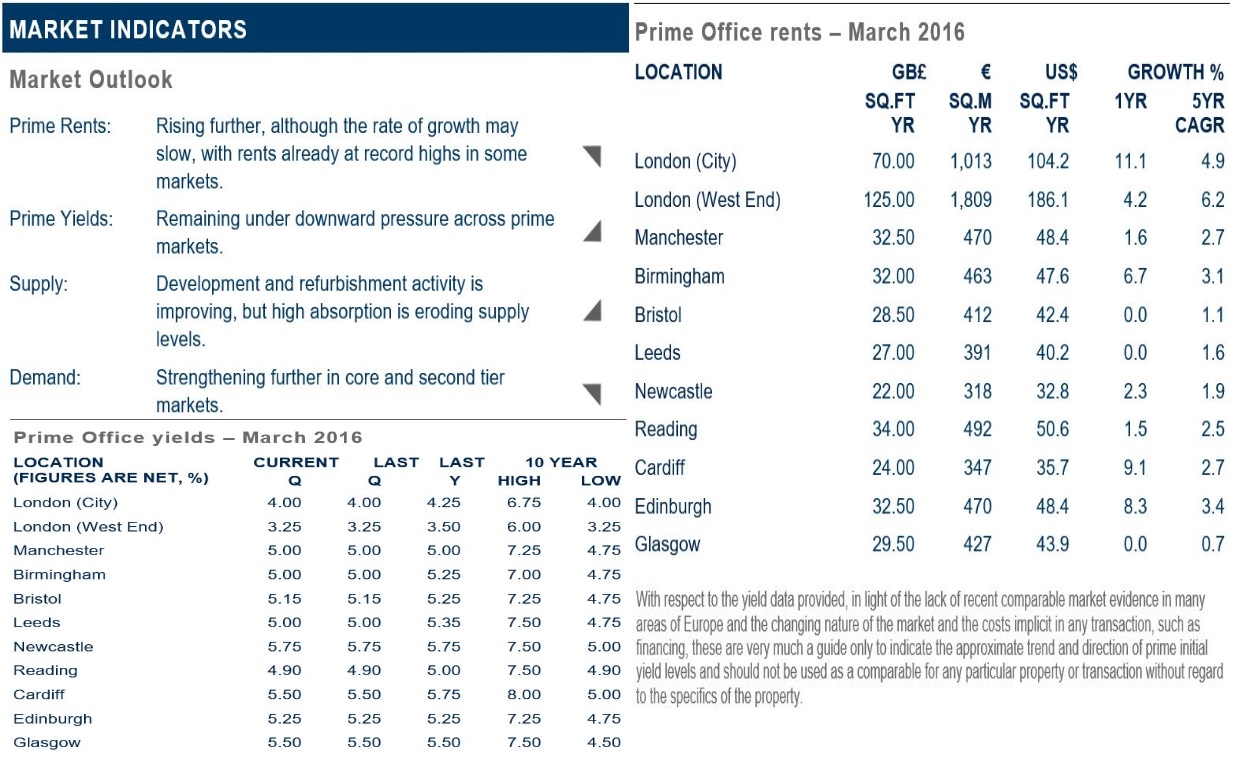

C&W OFFICE MARKETBEAT SNAPSHOT

Overview Q4 2015 GDP growth has been revised up to 0.6%, while there have also been upward revisions to growth in previous quarters, mainly due to a stronger than expected performance in the services sector. Full year growth for 2015 is now estimated to have been 2.3%. Downside risks remain, however, with concerns rising over global economic and financial uncertainty and the possibility of ...

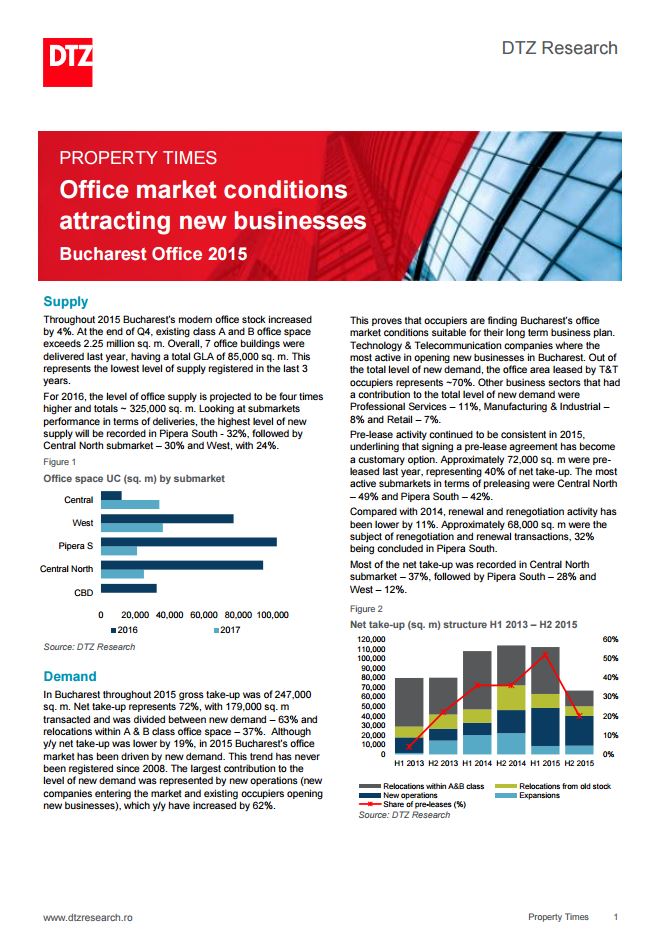

PROPERTY TIMES BUCHAREST OFFICE 2015

Throughout 2015 Bucharest’s modern office stock increased by 4%. At the end of Q4, existing class A and B office space exceeds 2.25 million sq. m. Overall, 7 office buildings were delivered last year, having a total GLA of 85,000 sq. m. This represents the lowest level of supply registered in the last 3 years. For 2016, the level of office supply is projected ...

WORKING HABITS AND COMMUTING PATTERNS 2019

July 2019: The employees working in modern offices in Bucharest spend an average of 46 minutes between home and work, while 52% of them consider the commuting time to be long or too long, according to the first edition of the Working Habits and Commuting Patterns study, realised by the real estate consultancy comapany Cushman & Wakefield Echinox. The average distance between home and ...

BUCHAREST OFFICE MARKETBEAT H1 2018

The total stock of A&B class office buildings in Bucharest was of 2.71 million sq. m at the end of H1 2018; New supply was quite limited, with only one project completed; When it comes to H2 2018, more than 150.000 sq. m of office space are expected to be completed; Demand continued to be strong throughout the first half of 2018, with West ...

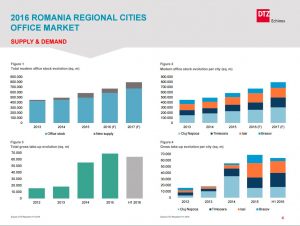

ROMANIA – OFFICE MARKET REGIONAL CITIES

In H1 2017, gross take-up in the main regional cities amounted ~40,000 sq. m, dropping by 50% when compared with 2016. The largest office deal closed in the first half of 2017 in a regional market has a rentable area of ~7,000 sq. m. and was delivered in Timisoara. Class A & B office space in Cluj Napoca, Timisoara, Iasi and Brasov reached 693,500 ...

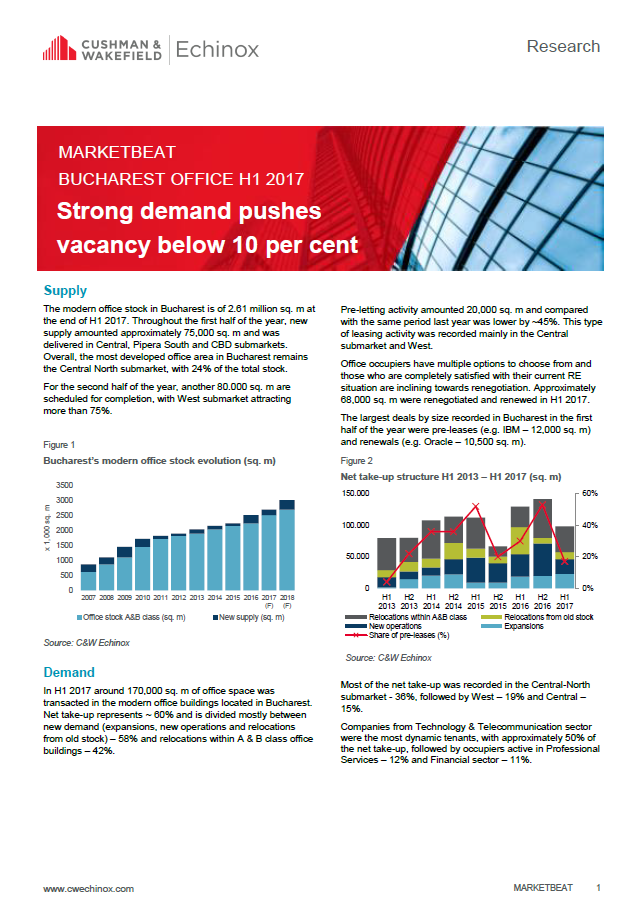

BUCHAREST OFFICE MARKETBEAT H1 2017

The modern office stock in Bucharest is of 2.61 million sq. m at the end of H1 2017. In H1 2017 around 170,000 sq. m of office space was transacted in the modern office buildings located in Bucharest Pre-letting activity was lower by ~45% compared with the same period last year. This type of leasing activity was recorded mainly in the Central submarket and ...

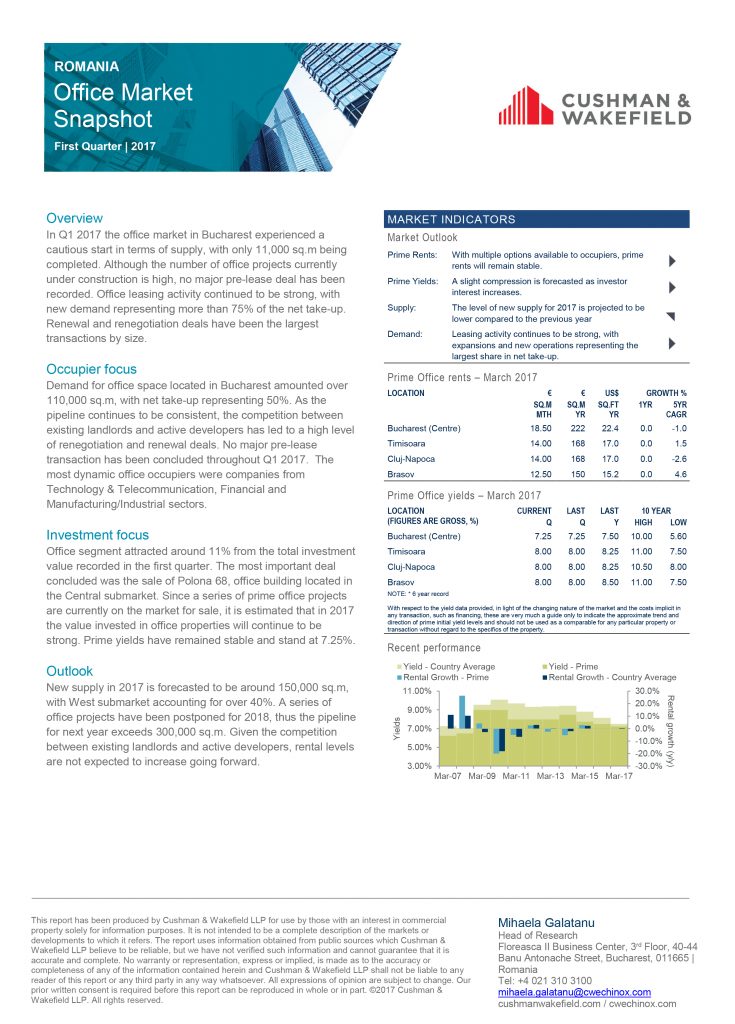

ROMANIA OFFICE SNAPSHOT Q1 2017

In Q1 2017 the office market in Bucharest experienced a cautious start in terms of supply, with only 11,000 sq.m being completed. Although the number of office projects currently under construction is high, no major pre-lease deal has been recorded. Office leasing activity continued to be strong, with new demand representing more than 75% of the net take-up. Renewal and renegotiation deals have been ...

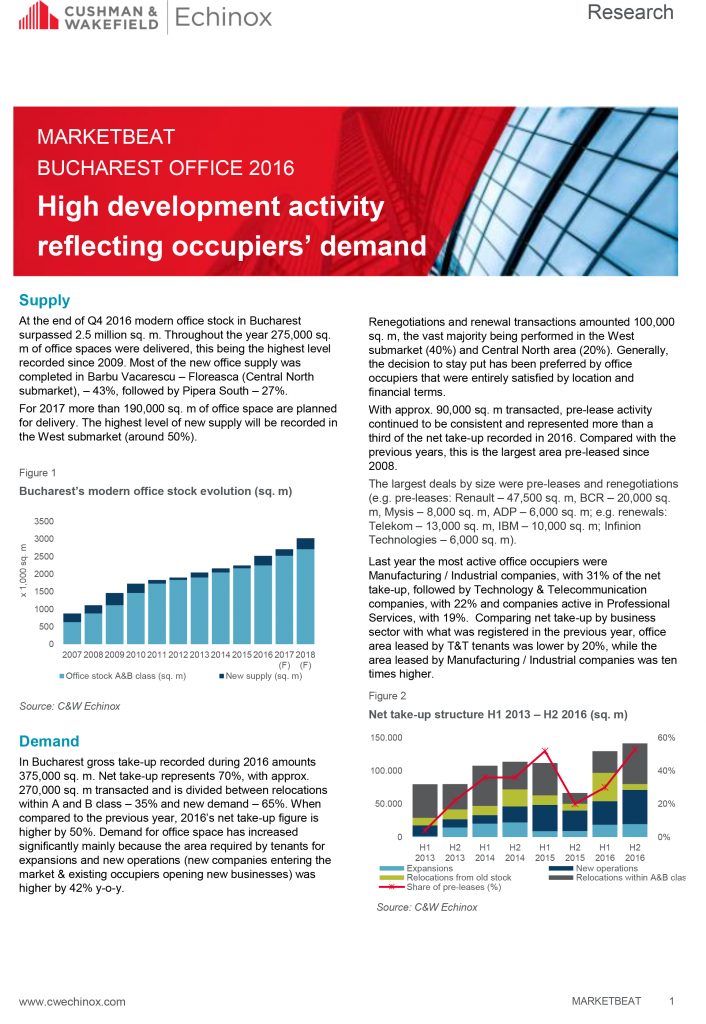

BUCHAREST OFFICE MARKETBEAT 2016

At the end of Q4 2016 modern office stock in Bucharest surpassed 2.5 million sq. m. Throughout the year 275,000 sq. m of office spaces were delivered, this being the highest level recorded since 2009. For 2017 more than 190,000 sq. m of office space are planned for delivery. When compared to the previous year, 2016’s net take-up figure is higher by 50%. Demand ...

ROMANIA OFFICE SNAPSHOT Q4 2016

Strong market performance recorded in Q4 has led the total office space transacted in Bucharest in 2016 to be of ~ 400,000 sq. m. As business confidence is high and occupancy costs continue to be attractive, the office market draws the interest of different types of occupiers, while office construction works are following the same positive trend.

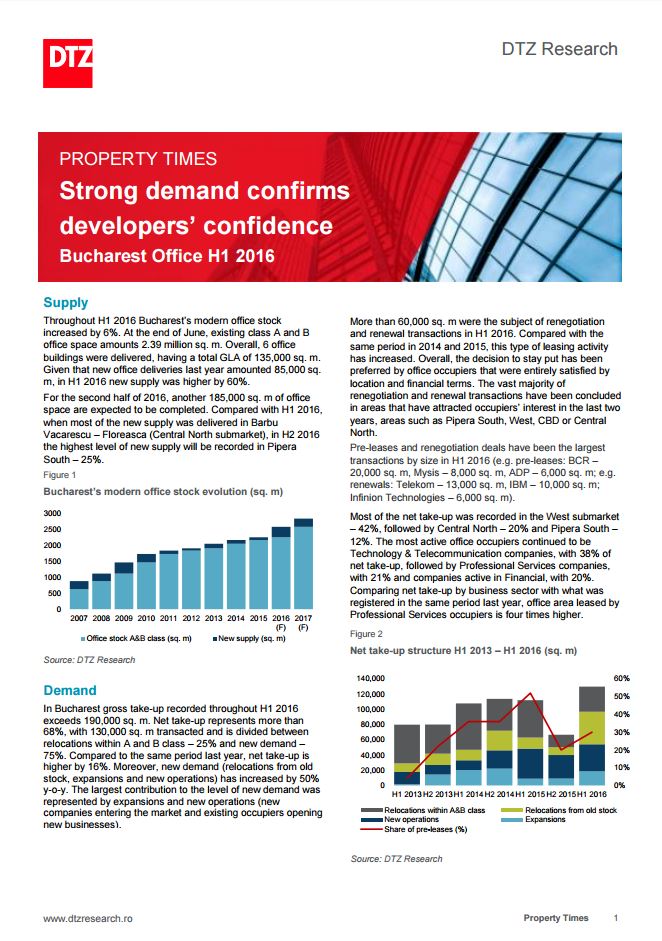

PROPERTY TIMES BUCHAREST OFFICE H1 2016

Throughout H1 2016 Bucharest’s modern office stock increased by 6%. At the end of June, existing class A and B office space amounts 2.39 million sq. m. Overall, 6 office buildings were delivered, having a total GLA of 135,000 sq. m. Given that new office deliveries last year amounted 85,000 sq. m, in H1 2016 new supply was higher by 60%. For the second ...

CWBPO SHARED SERVICE LOCATION INDEX 2016

The sustained growth of the sector is driven by the need for businesses to continue to seek cost-cutting and operating e¢ciency initiatives. Many countries see the value of attracting BPO inward investment, as it provides opportunities for significant employment and the job profiles are becoming increasingly diverse and high value. In India alone – the world’s largest BPO market, more than three million people ...

ROMANIA OFFICE REGIONAL CITIES 2016

Throughout 2015 gross take-up in the main regional cities amounted ~70,000 sq. m, being higher by 25% when compared with 2014. Net take-up represented 90%, with approximately 60,000 sq. m transacted and was divided between new demand (80%) and relocations within A & B stock. Pre-lease activity improved significantly. Compared with 2014, the office area subject of pre-lease transactions in 2015 was three times ...

BUCHAREST OFFICE Q1 2023

The y-o-y inflation rate reached 14.9% in Q1 2023 in Romania, a level which remains relatively high, but prices have been on a downward trend since the beginning of the year and the forecasts are now more optimistic, with single digit levels being expected before the end of 2023. The monetary policy rate has also been stabilized, as it has not been increased from ...

BUCHAREST OFFICE MARKET 2022

Around 500,000 sq. m of office spaces are unoccupied in Bucharest, reflecting a vacancy rate of 15.2%, the highest availability being reported in the Pipera North, Center-West and Floreasca – Barbu Vacarescu submarkets. There is still a significant discrepancy between A and B-class projects in terms of vacancy rates, a difference which could be addressed through investments made with the purpose of modernizing and ...

BUCHAREST OFFICE Q4 2022

The Q4 2022 office supply in Bucharest consisted of the 2nd building of the Equilibrium project (19,900 sq. m GLA) developed by Skanska in the Floreasca – Barbu Vacarescu submarket, thus bringing the total 2022 new supply to 124,000 sq. m GLA, the lowest such total since 2015. Therefore, the office stock in Bucharest was of 3.32 million sq. m at the end of ...

BUCHAREST OFFICE Q3 2022

The prime headline rent in Bucharest continued to increase in Q3 2022, reaching a level of around €19.50/ sq. m/month in the CBD area, with further increases expected in other submarkets in the following 6 – 12 months due to the relatively low office pipeline. There are currently new office projects of 129,000 sq. m GLA which are under construction, a low pipeline compared ...

BUCHAREST OFFICE Q2 2022

The prime headline rent in Bucharest has seen a small increase in Q2 2022 to a level of around €19.00/ sq. m/month in the CBD area, a trend which is also expected in other high profile submarkets such as Center and Floreasca – Barbu Vacarescu by the end of the year. The existing pipeline of under construction office projects (134,000 sq. m GLA) is ...