Bucharest, January 2021: In 2020, the total volume invested in real estate assets in Romania reached €914 million, a 28% increase compared 2019, illustrating the overall resiliency of the Romanian investment market during the Covid-19 pandemic, according to the Romania Investment Marketbeat launched by Cushman & Wakefield Echinox real estate consultancy firm.

The most active segment was by far the Office sector, with estimated transaction values of approximately €784 million, representing 86% of the total investment value. The Industrial segment attracted 9% of the capital, while the remaining 5% were split between the Retail and Hospitality sectors. In total, a number of 24 income-producing properties were transacted in 2020, an average of €38 million per property, one of the highest such values in the last decade on the local real estate market.

The six largest transactions pertained to office projects, including the disposal of NEPI Rockcastle’s office portfolio to AFI Europe. The transaction consisted of four office buildings in Bucharest and Timisoara totaling 118,000 sq. m GLA, which were sold for €307 million, the largest office deal ever signed in Romania.

Moreover, the €100 million threshold was exceeded by a number of other office transactions, the most relevant for the market being the purchase of Floreasca Park, a landmark 38,000 sq. m GLA office project, by a joint venture between Zeus Capital Management and Resolution Property (Fosun), marking the entry of Chinese investors on the Romanian office market.

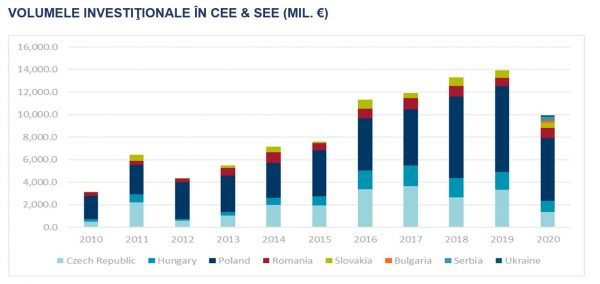

The overall increase of the investment volume is even more impressive in the entire CEE/SEE context, as the Romanian market was the only one which recorded a growth in 2020 compared to 2019. As such, real estate properties with a cumulative value of €9.9 billion were transacted in the region in 2020, an almost 29% decrease from the 2019 volume. For example, Poland, which has the highest share in the total volume (57%), recorded a 27% decrease, Hungary even more at -35%, while Czech Republic had the most dramatic drop at 60%, thus showing the resilience of the Romanian market which performed way above expectations in a very complicated year.

Tim Wilkinson, Partner, Capital Markets, Cushman & Wakefield Echinox: „Romania showed strong signals in 2020 that it has reached a new level of market liquidity, with total investment volumes again being close to Eur 1 billion, even though the year was marked by the challenges of the pandemic. This consistent trend stood out from more developed markets of CEE, where we saw significant reductions in 2020 investment volumes compared to 2019. Although Romania remains a much smaller market than Poland, it shortened the gap between total volumes when compared to Hungary and the Czech Republic.

In 2021, we can expect to see industrial & logistics investor demand strengthen further, with the medium term forecast that this asset class will become one of the top 2 most active sectors, alongside offices. A positive 12 months for the market overall and data that will no doubt attract more interest in the market from new equity, especially considering the fact that yields remain significantly more attractive than the more developed markets of CEE.”

Cushman & Wakefield Echinox is a top real estate consulting company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 60 professionals and collaborators offering a full range of services to investors, developers, landlords and tenants. For more information, visit www.cwechinox.com

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 53,000 employees in over 60 countries and € 8.8 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation, design and evaluation services. For more information, visit www.cushmanwakefield.com