Throughout 2015 Bucharest’s modern office stock increased by 4%. At the end of Q4, existing class A and B office space exceeds 2.25 million sq. m. Overall, 7 office buildings were delivered last year, having a total GLA of 85,000 sq. m. This represents the lowest level of supply registered in the last 3 years.

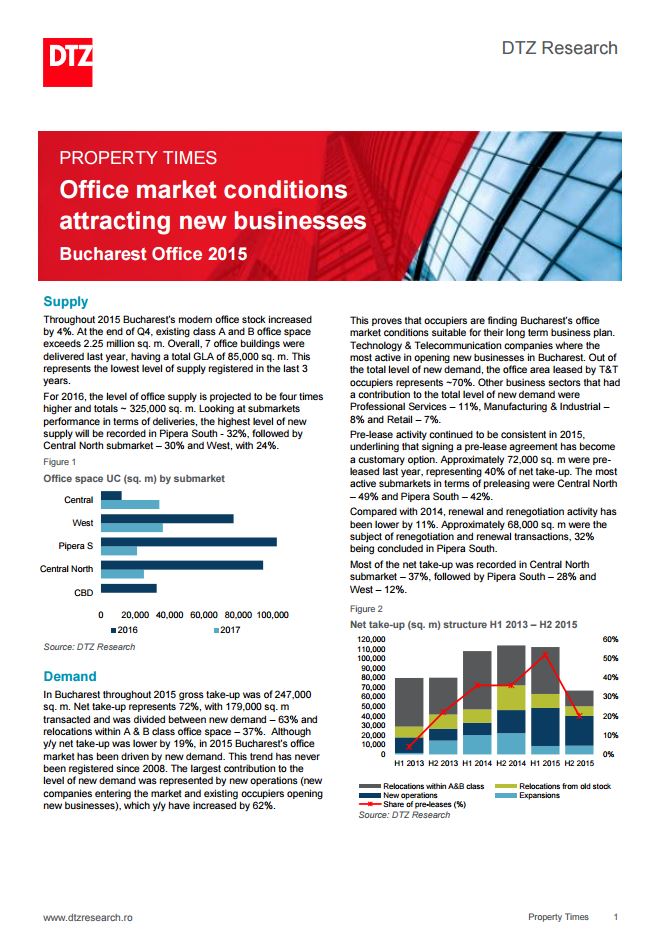

For 2016, the level of office supply is projected to be four times higher and totals ~ 325,000 sq. m. Looking at submarkets performance in terms of deliveries, the highest level of new supply will be recorded in Pipera South – 32%, followed by Central North submarket – 30% and West, with 24%.

In Bucharest throughout 2015 gross take-up was of 247,000 sq. m. Net take-up represents 72%, with 179,000 sq. m transacted and was divided between new demand – 63% and relocations within A & B class office space – 37%. Although y/y net take-up was lower by 19%, in 2015 Bucharest’s office market has been driven by new demand. This trend has never been registered since 2008. The largest contribution to the level of new demand was represented by new operations (new companies entering the market and existing occupiers opening new businesses), which y/y have increased by 62%.

This proves that occupiers are finding Bucharest’s office market conditions suitable for their long term business plan. Technology & Telecommunication companies where the most active in opening new businesses in Bucharest. Out of the total level of new demand, the office area leased by T&T occupiers represents ~70%. Other business sectors that had a contribution to the total level of new demand were Professional Services – 11%, Manufacturing & Industrial – 8% and Retail – 7%.